Discover the Power of Short-Term Rentals: Cash Flow, Tax Savings, and More...

Short-term rentals are more than just vacation homes—they’re a smart way to make money, build wealth, and save on taxes. Here’s how owning an STR can work for you.

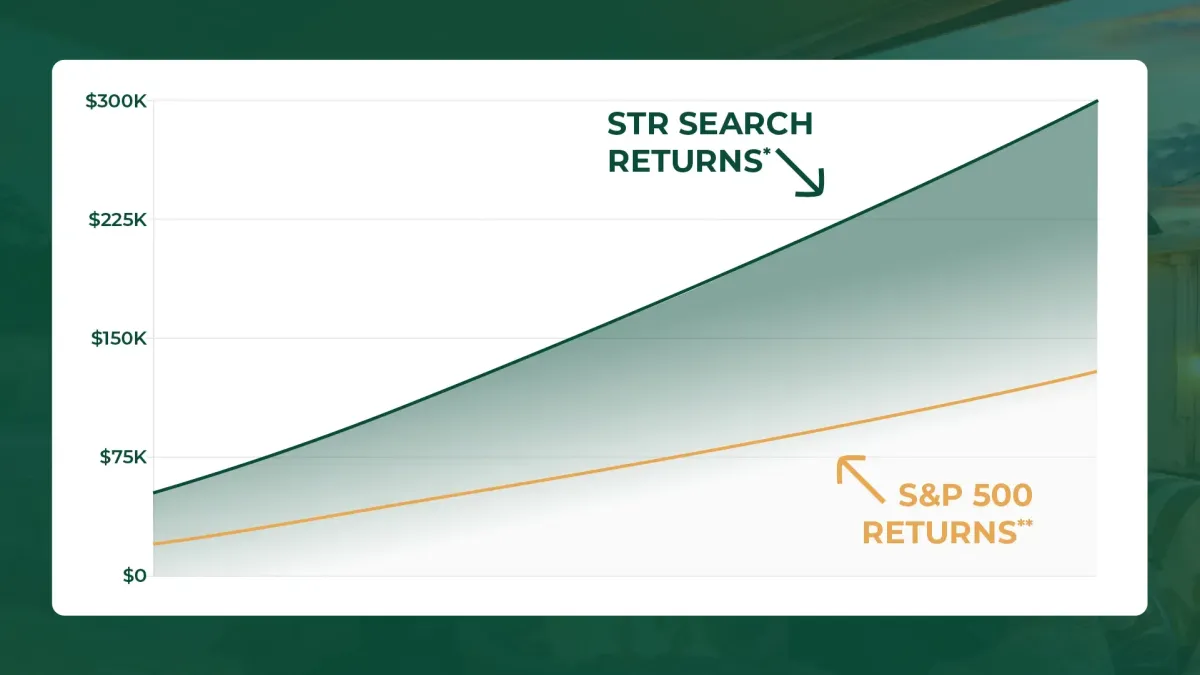

Projected Cumulative Returns - 5 Years

Total Returns

$303,104

CashFlow

$186,442

Equity

$23,037

Appreciation

$93,625

Disclaimer:

*The projected cumulative returns for STR Search Returns and S&P 500 Returns are for illustrative purposes only and do not guarantee future performance. Projections are based on historical data and assumptions that may not reflect actual market conditions or future outcomes. Investment outcomes are subject to market risks, including loss of principal. Past performance does not guarantee future results. Always consult with a licensed financial advisor before making investment decisions.

**S&P 500 projected returns based on the home cash outlay amount invested into SPY, SPDR S&P 500 ETF Trust at a 9.72% average annual return rate

Pays You Today: Cash Flow

Owning a short-term rental gives you income now, not years down the road. Let’s break it down:

How You Make Money: People pay to stay in your home. This is your rental income. For example, if your STR in Florida generates $100,000 in yearly bookings and operating expenses (like cleaning, maintenance, and utilities) might take 40%, you’re left with $60,000.

Covering the Mortgage: If you financed the property with 20% down, your monthly mortgage (principal and interest) might be about $2,661. That’s $31,932 a year.

Your Profit: After paying all the expenses and mortgage, you could see $28,068 left over in your pocket. That’s money you can use now—for vacations, savings, or other investments.

Why STRs Are Better: With short-term rentals, you can charge higher nightly rates compared to long-term rentals. This means more cash flow for you.

Builds Wealth in Your Sleep: Equity and Appreciation

Short-term rentals don’t just pay you now—they help you grow your wealth over time. Here’s how:

Equity from Paying Down the Mortgage: Every month, part of your mortgage payment goes toward reducing your loan. Over time, you own more of your property. For example, after 5 years of owning a $500,000 home, you could pay down about $20,000 in principal. That’s equity you’ve built!

Appreciation: Real estate typically increases in value over time. If your $500,000 home appreciates at the national average of 4.8% per year, it could be worth approximately $633,000 in 5 years. That’s a $133,000 increase in value—on top of the equity you’re building by paying down your loan.

Leverage: You’re building wealth on the entire $500,000 property, even though you only put $100,000 down. This is the power of leverage—it magnifies your returns.

Why STRs Are Better: STRs help you pay off your mortgage faster because of higher income, meaning you can build equity more quickly than with a traditional rental.

Saves You Money at Tax Time: Tax Benefits

Owning an STR isn’t just about making money—it’s about keeping more of it. Short-term rentals offer unique tax benefits that other investments can’t match. Here’s what that means for you:

Bonus Depreciation: The IRS lets you deduct a portion of your property’s value each year, even though it’s likely going up in value. For example, if your $500,000 home has a $300,000 depreciable value, you could leverage a cost segregation study to accelerate your “paper losses” on your property. What this means is if you’re in a 35% tax bracket, that’s over $100,000 in tax benefits to you.

Short-Term Rental Tax Loophole: Unlike long-term rentals, you may qualify to use losses from your STR to offset other income—like your salary. To qualify, you need to meet certain activity rules. This loophole can save you tens or hundreds of thousands in taxes every year.

Why STRs Are Better: The combination of these tax benefits means you keep more of what you earn—allowing you to reinvest in other properties or enjoy the financial freedom you’ve built.

Your Investment, Your Retreat: Personal Use and Memories

Owning a short-term rental doesn’t just make financial sense—it adds value to your life. Here’s how:

Personal Use: Imagine being able to stay in your own vacation home, knowing it’s paid for by guests when you’re not there. Whether it’s a weekend getaway or a family holiday, your STR can double as your personal retreat.

Memories That Matter: A short-term rental is more than an investment; it’s a place where you and your loved ones can create lasting memories. Instead of renting someone else’s home, you’ll own the space where your favorite moments happen.

Flexibility: You control when you want to use the property. Unlike a long-term rental, there are no leases tying up your schedule, so you can enjoy your home when it works best for you.

Protect Your Wealth: Diversification

Short-term rentals offer a way to reduce risk while growing your financial portfolio. Here’s why diversification matters:

Multiple Income Streams: Your STR provides an additional source of income outside of your job or other investments. This helps protect you if one area of your finances takes a hit.

Real Estate Stability: Real estate is generally less volatile than stocks, and short-term rentals, in particular, can adapt to market conditions. For example, during economic slowdowns, people often opt for affordable, local vacations, keeping STR demand steady.

Geographic Opportunities: You can invest in different markets, spreading your risk. For instance, owning properties in both mountain and beach destinations ensures year-round income.

Diversified Returns & Leverage

Short-term rentals let you do more with less. By using financing, you can grow your wealth faster and in multiple ways with one investment:

Maximized Buying Power: With a $100,000 down payment, you control a $500,000 property. This means any appreciation or income is based on the full value, not just your initial investment.

Accelerated Wealth Growth: Let’s say your property appreciates at 4.8% per year. That’s $133,000 in gains based on the full $500,000 value, not just your $100,000 down payment.

Smarter Investments: By leveraging financing, you can buy multiple properties instead of one. For example, you could own two $500,000 homes with strong returns instead of putting all your money into one.

Why STRs Are Better: Leverage makes your money work harder, increasing your overall returns and helping you grow your portfolio faster.

The Bottom Line

Short-term rentals give you income today, build wealth for tomorrow, and offer unique advantages like tax savings, flexibility, and diversification. With STRsearch, we’ll help you find the best markets, properties, and strategies to make your STR a success—whether you’re looking for financial freedom, a smart investment, or a home to enjoy.

We're Trusted By the Best in the Business

STR Search and the Bianchi Method has gained a reputation among industry leaders as being the front runner in consistently matching people with profitable properties.

Avery Carl

- Founder of The Short Term Shop

Rob Abasolo

- Founder of Host Camp and Youtube Channel Robuilt

Sief Khafagi

- Founder of Techvestor

Jeremy Werden

- Founder of BNBCalc

Dr. Rachel Gainsbrugh

- Founder Short Term Gems

Avery Carl

- Founder of The Short Term Shop

Rob Abasolo

- Founder of Host Camp and Youtube Channel Robuilt

Sief Khafagi

- Founder of Techvestor

Jeremy Werden

- Founder of BNBCalc

Dr. Rachel Gainsbrugh

- Founder Short Term Gems

Put your money to work & lower your tax bill with a high performing Airbnb

Years of passionate analysis have equipped us with the insights to safeguard your investments against unprofitability.

Our dedication stems from a genuine desire to help you thrive. Trust us to steer you away from the pitfalls of bad data

and towards the rewards of wise property investment.

Disclaimer: STR Search strives to provide valuable insights and strategies for optimizing short-term rental (STR) investments. While we aim to help clients put their money to work and potentially lower their tax bills, we cannot guarantee the financial performance of any property or investment. Real estate markets are inherently unpredictable, and individual results may vary based on factors such as location, market conditions, management practices, and other variables outside our control. Additionally, lowering your tax bill through STR investments may require you to meet specific qualifications outlined in the IRS Passive Activity Loss Rules and the Short-Term Rental Exception. We encourage all clients to consult with a qualified tax professional or financial advisor to determine their eligibility for this tax benefit and to understand the implications of their investment decisions. By engaging with our services, you acknowledge that all investments carry risk, and past performance is not indicative of future results. STR Search is not a tax, financial, or legal advisory firm, and any information provided should not be considered as such.

FAQ

Isn't Airbnb too Saturated?

On the contrary, the perceived saturation of 2024's Airbnb market opens doors for savvy investors. With the right data at your disposal, you can uncover hidden markets and investment opportunities that others overlook, positioning you perfectly to excel where others see obstacles.

How much money do I need?

An ideal investment of at least $150,000 is recommended to launch an Airbnb venture effectively. This figure may appear substantial, yet it reflects the genuine expenses involved in establishing a high-standard Airbnb operation. With our extensive experience of over 180 successful setups, we possess a deep understanding of the necessary investment. It's important to be cautious of advice suggesting lower costs, as it often implies a compromise in quality or an expectation for you to undertake significant groundwork. However, should you choose to proceed with a smaller budget and manage the listing setup independently, we remain eager to support your endeavors and would love to work with you.

Do I need a Realtor?

While realtors are crucial for understanding local market dynamics and finding properties, their expertise typically doesn't cover the financial intricacies of forecasting cash flow for short-term rentals. This requires specific analysis and tools beyond traditional real estate knowledge.

Cool, but why you?

I do this for the love. And it just happens to help a lot of people. It works. Not being cocky, but it does. People praise you in public for what you practice in private.