Wait — Don’t Miss This Next Step

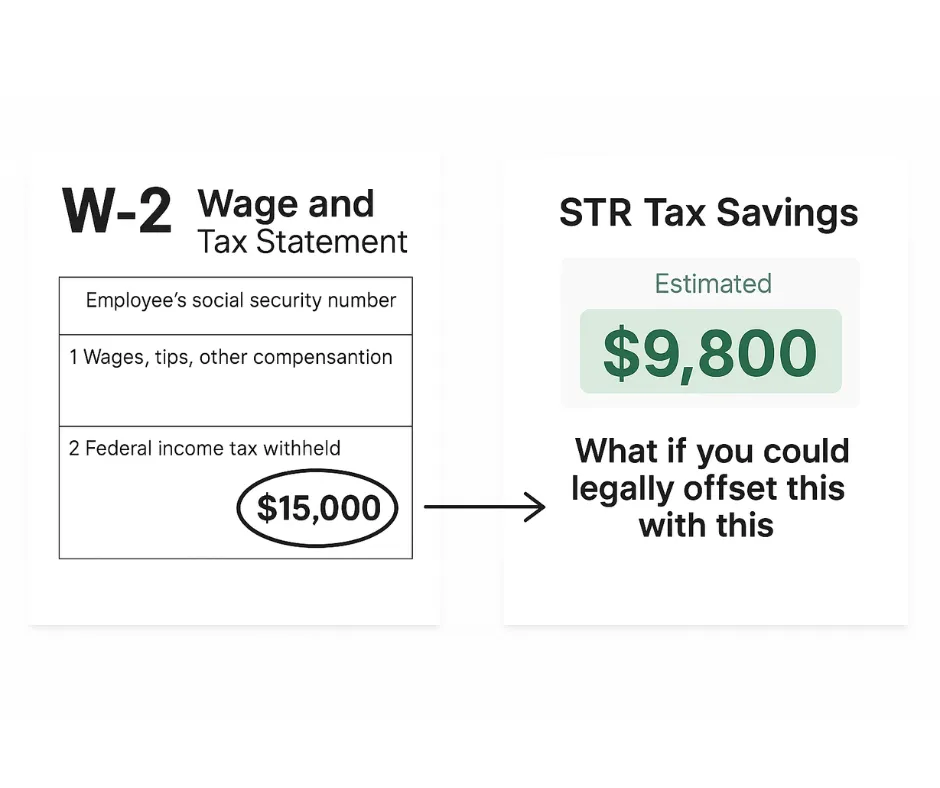

Your Tax Savings Estimate Is Just the Beginning...

If you’re serious about using the STR tax loophole to reduce what you owe — you need to know exactly how it works.

Get the Complete STR Tax Loophole Playbook

If you’ve ever dreamed of investing in real estate but haven’t made a move because…

❌ You thought real estate tax strategies were only for the ultra-wealthy

❌ You assumed you needed to be a full-time investor to benefit

❌ Or you simply didn’t know where to start…

✅ Then what you’re about to access will change everything.

Here’s why:

My name is John Bianchi, and I’ve helped clients acquire more than 200 short-term rental properties in just the last 3 years — all with a 100% success rate.

What I realized is that most high-income professionals are playing defense when it comes to taxes. They max out their 401(k), itemize deductions, and hope for the best. But these “standard” strategies barely move the needle.

That’s why I created this.

The STR Tax Loophole Playbook is your step-by-step guide to understanding one of the

most powerful, IRS-approved strategies in the tax code today.

It’s not just about writing off expenses — it’s about using short-term rentals to legally offset active income, including your W-2 or business income.

Inside the playbook, I break down exactly:

- How the STR loophole works (and why the IRS allows it)

- Who qualifies — and what to avoid if you want to stay compliant

- How to prove material participation and track it properly

- How to structure your investment so it works for you at tax time

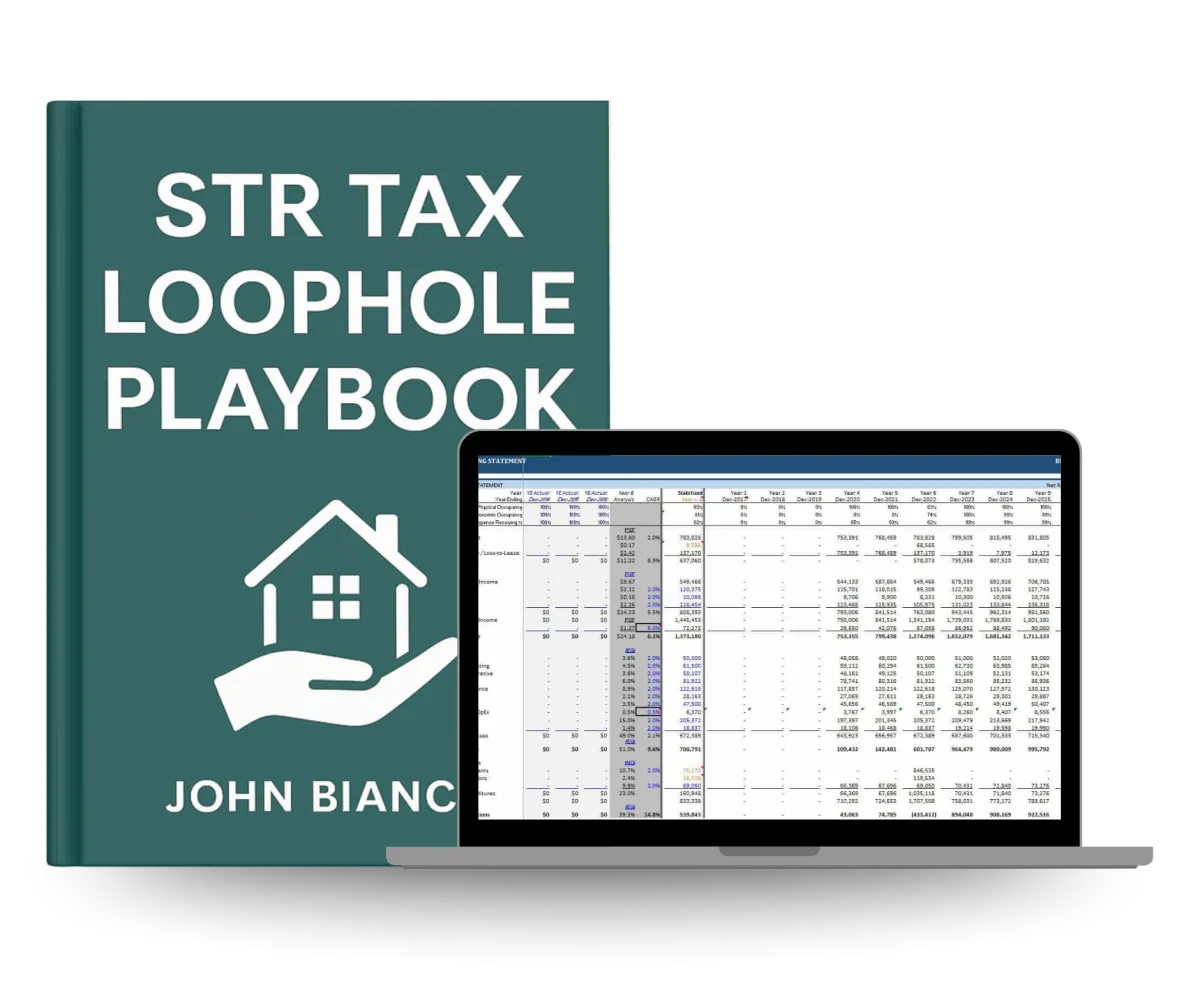

- And how to underwrite properties using the exact sheet I use with clients

Here’s the truth:

Most high earners are frustrated come tax season. They max out their retirement accounts, itemize what they can, and still end up with a massive bill. And when they try to explore real estate for the tax benefits? They're met with generic advice and overpriced spreadsheets that don’t actually help.

In fact, I once paid $500 for an underwriting sheet from a well-known guru… and it was borderline useless. It didn’t account for real costs, STR-specific metrics, or any of the things that matter when you’re trying to see if a deal truly qualifies for the STR tax loophole.

So I built something better.

Now Available For Instant Access

Only $498.00 $47.00

Save $451.00 today

Download The Course For Just $47.00! Delivered instantly.

Start watching in the next 2 minutes.

Now Available For Instant Download

100% secure 256-bit encrypted checkout

High-Value Bonus: The Sheet I Use With Paying Clients

When I bought a “guru-approved” sheet for $500, it was confusing, incomplete, and didn’t even apply to STR tax rules.

So I built a better one — and now I'm including it in this $47 bundle.

You’ll get the exact sheet I use with clients to quickly analyze deals, project cash flow, and see if a property qualifies for the STR tax loophole.

HERE'S EXACTLY WHAT YOU'LL GET FOR ONLY $47

The STR Tax Loophole Playbook

Full 100‑page PDF playbook --------------------------- $299 value

STR underwriting sheet --------------------------- $199 value

Total value = $498

Today only = $47

WHAT's INSIDE?

The 5-Step STR System

1. Diagnose your tax opportunity

See exactly how much you can offset against your W2 or business income

2. Qualify with material participation

Nail the seven‑day rule and log the hours that turn paper losses into real savings

3. Maximize paper losses with depreciation

Use cost segregation and bonus depreciation to front‑load deductions

4. Find and underwrite winning properties

Apply AirDNA data and the 20 percent rule to spot market‑beating deals

5. Build and protect your wealth

Assemble your team and lock in best practices for compliance and growth

TESTIMONIALS

What Others Are Saying

“Working with STR Search was a game-changer.”

"They helped us find an off-market STR property with over 25% cash-on-cash return, and their recommended CPA helped us save more than $80,000 in taxes our first year."

- Dr. Sarah Chen, California

“I didn’t have time to sort through hundreds of listings.”

"John’s team brought me three vetted options. I closed on one within 60 days, and it’s already exceeding revenue projections."

- John Miller, Tech Executive, Texas

Disclaimer: STR Search strives to provide valuable insights and strategies for optimizing short-term rental (STR) investments. While we aim to help clients put their money to work and potentially lower their tax bills, we cannot guarantee the financial performance of any property or investment. Real estate markets are inherently unpredictable, and individual results may vary based on factors such as location, market conditions, management practices, and other variables outside our control. Additionally, lowering your tax bill through STR investments may require you to meet specific qualifications outlined in the IRS Passive Activity Loss Rules and the Short-Term Rental Exception. We encourage all clients to consult with a qualified tax professional or financial advisor to determine their eligibility for this tax benefit and to understand the implications of their investment decisions. By engaging with our services, you acknowledge that all investments carry risk, and past performance is not indicative of future results. STR Search is not a tax, financial, or legal advisory firm, and any information provided should not be considered as such.