100% Free Step-By-Step Course:

STR Tax Pro Reveals the “Short-Term Rental Loophole” That Helps Investors Keep More of What They Earn

Without Overpaying or Guessing on Strategy

In this free step-by-step course, You will Learn:

FILL OUT THE FORM BELOW TO GET INSTANT ACCESS

In this free step-by-step course, You will Learn:

Use the STR tax loophole to significantly reduce your tax bill and keep more of your income

Avoid common tax mistakes that cause real estate investors to miss out on major savings

Ask the right questions to find out if your accountant truly understands STR tax strategy

FILL OUT THE FORM BELOW TO GET INSTANT ACCESS

Trusted by hundreds of successful investors

Meet John Bianchi: The Airbnb Data Guy

John Bianchi’s journey into real estate didn’t begin with properties—it began with data.

As he searched for the right career path, John realized he had a unique talent: breaking down short-term rental data to find patterns others missed. Instead of diving in immediately, he dedicated himself to mastering the skill.

Since then, John has become one of the most trusted names in Airbnb investing. As the founder of STR Search, John has directed over $90 million in short-term rental investments across 200+ properties—with a 100% success rate. His method isn’t guesswork. It’s a step-by-step system built on real-world data, refined across hundreds of deals, and proven to identify properties that consistently outperform the market.

From selecting top-performing markets and forecasting revenue, to optimizing amenities and avoiding risky areas, John’s strategies are used by investors across the country looking to build recession-proof, cash-flowing portfolios.

Now, in his free 7-day course, John walks you through the exact system he’s used to evaluate more than 100 properties—and gives you the tools to confidently analyze, underwrite, and invest in short-term rentals that book and cash flow.

Whether you're just getting started or looking to level up your portfolio, John is here to guide you with the same proven blueprint that built his 7-figure Airbnb business from the ground up.

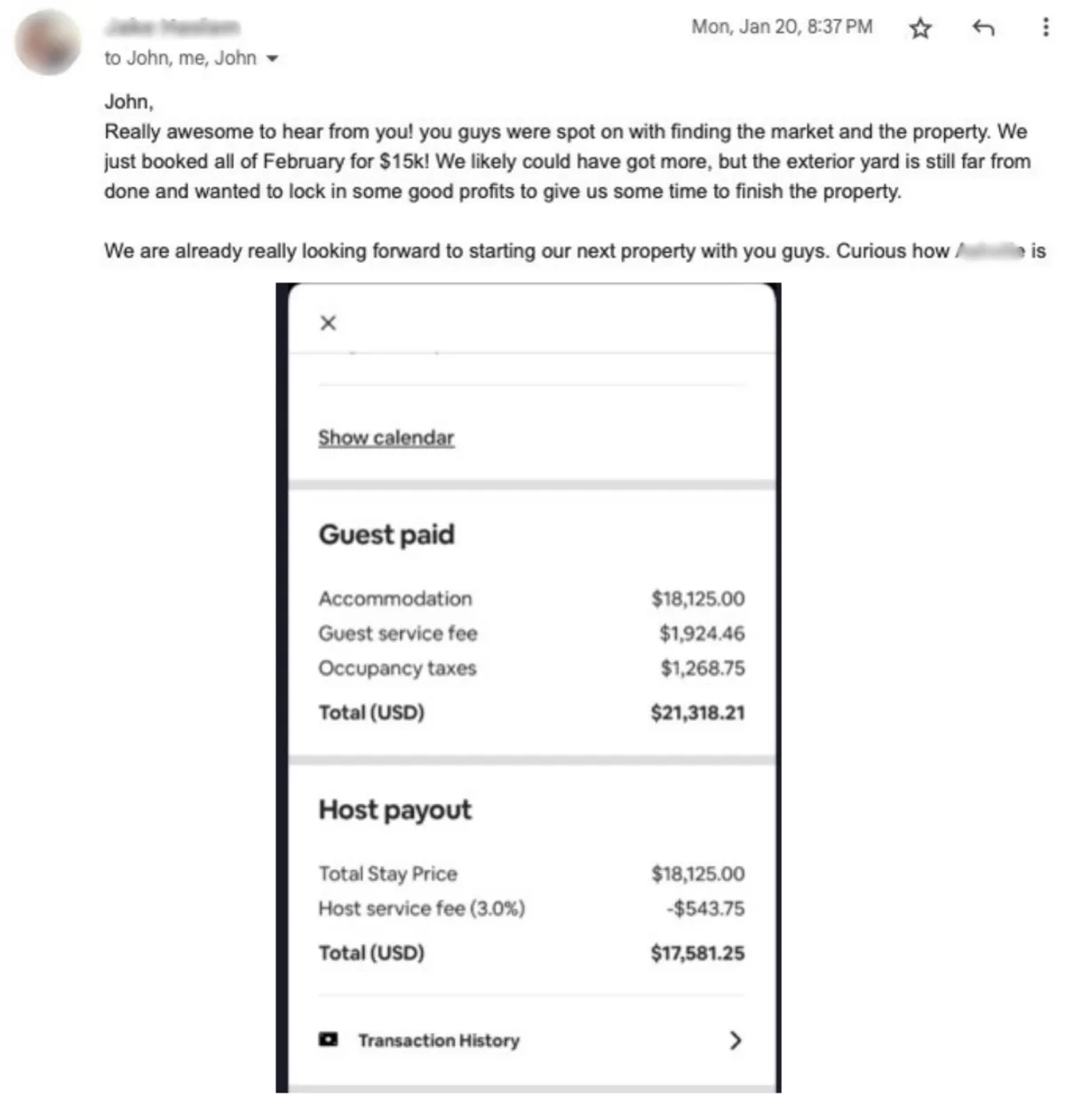

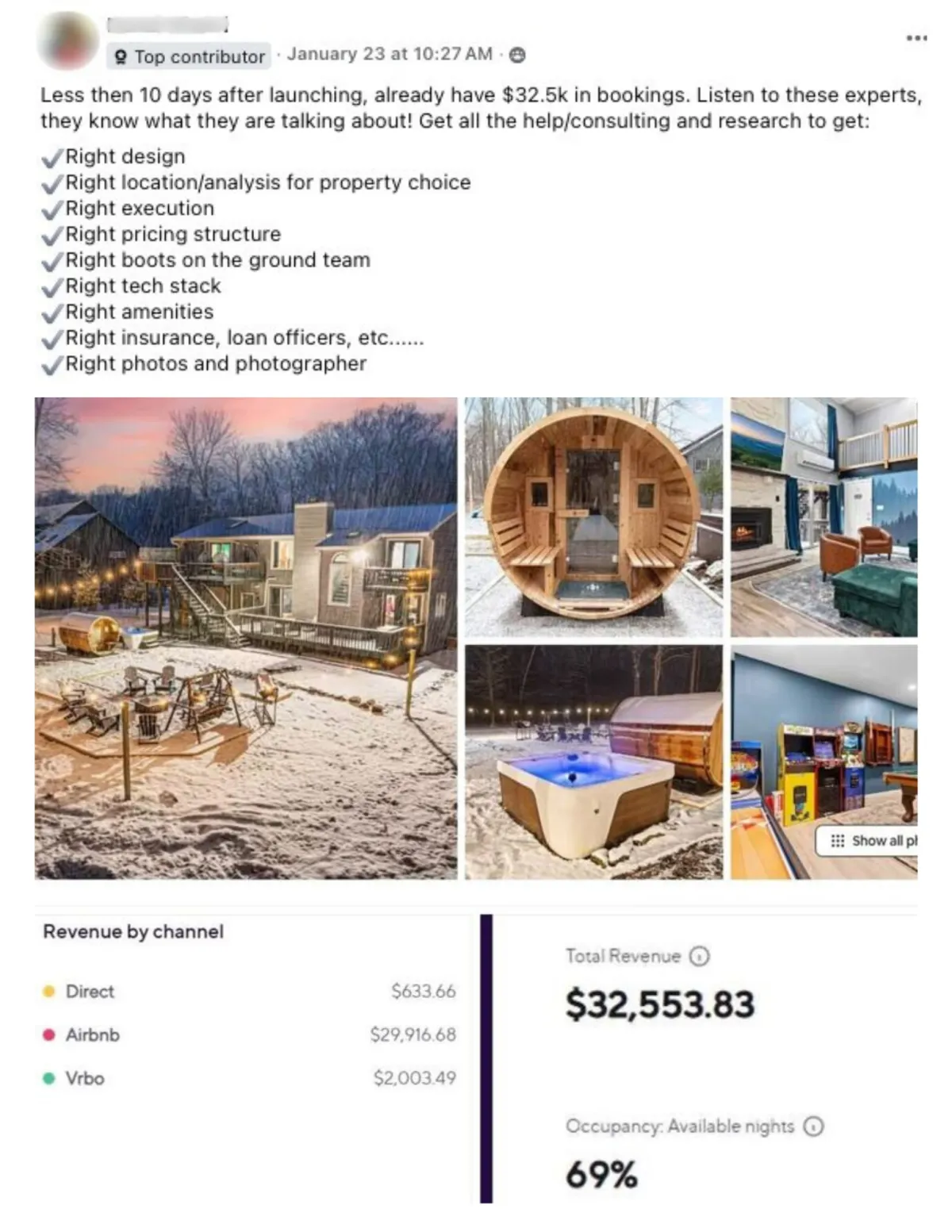

Just Some of Our Success Stories

From first-time investors to seasoned pros, see how our commitment to comprehensive data analysis led to unparalleled investment victories.

"Thanks to John's expert guidance, I made my first real estate and Airbnb investment a massive success, with consistent positive cash flow and an exceptional return on investment!"

Arul

"John's training gave me the confidence to secure a loan on the spot and scale from one STR to three—his approach is a total game-changer!"

Philip

Disclaimer: STR Search strives to provide valuable insights and strategies for optimizing short-term rental (STR) investments. While we aim to help clients put their money to work and potentially lower their tax bills, we cannot guarantee the financial performance of any property or investment. Real estate markets are inherently unpredictable, and individual results may vary based on factors such as location, market conditions, management practices, and other variables outside our control. Additionally, lowering your tax bill through STR investments may require you to meet specific qualifications outlined in the IRS Passive Activity Loss Rules and the Short-Term Rental Exception. We encourage all clients to consult with a qualified tax professional or financial advisor to determine their eligibility for this tax benefit and to understand the implications of their investment decisions. By engaging with our services, you acknowledge that all investments carry risk, and past performance is not indicative of future results. STR Search is not a tax, financial, or legal advisory firm, and any information provided should not be considered as such.