How Much Could You Save on Taxes by Investing in a Short-Term Rental?

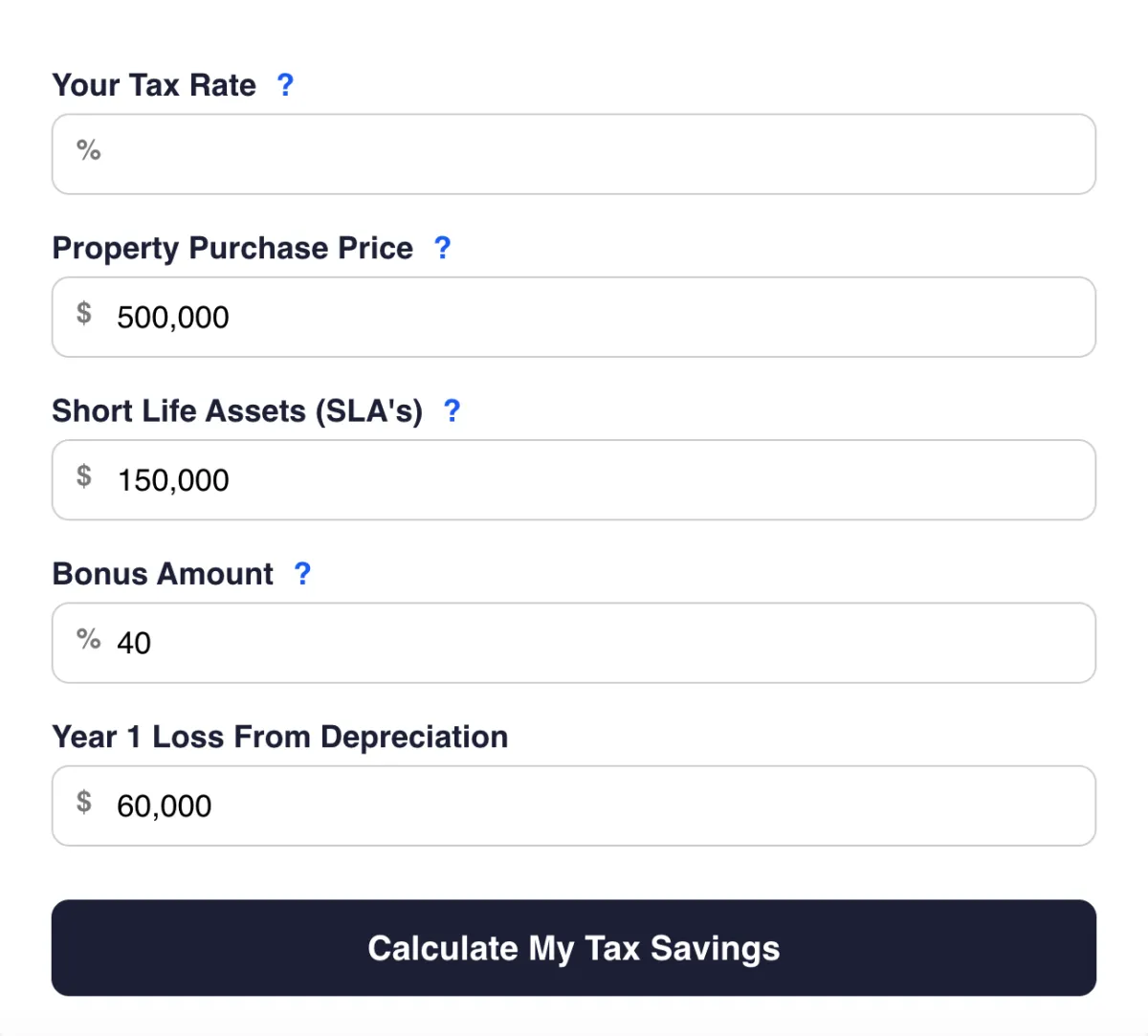

Use Our Free 30-second calculator to estimate how much money you’re leaving on the table — and see why thousands of investors are using this IRS-approved strategy to keep more of what they earn

What You'll Discover

A simple way to estimate your tax savings in 60 seconds or less

Clarity on how STR investing compares to traditional rentals and W-2 income

A clear next step if you want to start taking advantage of the STR tax loophole

Why We Made This Calculator

Real estate investors — and even regular W-2 earners — are missing out on

thousands in potential tax deductions

every year simply because they’re unaware of how powerful short-term rentals can be.

That’s exactly why John Bianchi, better known as The Airbnb Data Guy, built this calculator. After helping thousands of investors optimize their short-term rental portfolios, John saw one major blind spot over and over again: most people don’t realize how much they could be saving on taxes.

This tool is designed to help you:

- See what the IRS doesn’t advertise

- Quantify your potential tax savings based on your income

- Decide if STR investing is a smart move for you

Find Out How Much You Could Start Saving

Disclaimer: STR Search strives to provide valuable insights and strategies for optimizing short-term rental (STR) investments. While we aim to help clients put their money to work and potentially lower their tax bills, we cannot guarantee the financial performance of any property or investment. Real estate markets are inherently unpredictable, and individual results may vary based on factors such as location, market conditions, management practices, and other variables outside our control. Additionally, lowering your tax bill through STR investments may require you to meet specific qualifications outlined in the IRS Passive Activity Loss Rules and the Short-Term Rental Exception. We encourage all clients to consult with a qualified tax professional or financial advisor to determine their eligibility for this tax benefit and to understand the implications of their investment decisions. By engaging with our services, you acknowledge that all investments carry risk, and past performance is not indicative of future results. STR Search is not a tax, financial, or legal advisory firm, and any information provided should not be considered as such.